Financial analyst jobs for freshers in Pune present an exciting opportunity for new graduates embarking on their professional journey. This vibrant city, known for its booming economy and diverse industries, is increasingly seeking fresh talent to navigate the complexities of financial data and corporate strategy.

As the demand for skilled financial analysts continues to rise, freshers can find ample opportunities across sectors such as IT, manufacturing, and finance, making it an ideal starting point for their careers. With the right qualifications and skills, fresh graduates can position themselves for success in this competitive job market.

Overview of Financial Analyst Jobs in Pune

The role of a financial analyst has gained significant traction in recent years, particularly in vibrant job markets like Pune. As a city known for its rapid economic growth and diverse industry landscape, Pune provides ample opportunities for fresh graduates aspiring to build a career in finance. Financial analysts play a crucial role in analyzing financial data, preparing reports, and providing insights that help organizations make informed decisions.The responsibilities of financial analysts typically encompass evaluating investment opportunities, conducting market research, and creating financial models.

Analysts are expected to interpret complex financial information, assist in budgeting processes, and monitor financial performance against targets. Additionally, they provide recommendations to senior management based on their findings, ensuring that companies align their financial strategies with overall business objectives.

Demand for Financial Analysts in Pune’s Job Market

Pune’s job market demonstrates a robust demand for financial analysts, driven by the city’s thriving economy and a diverse range of industries. The growth in sectors such as information technology, manufacturing, and services has led to an increase in the need for professionals who can provide key insights into financial performance. Companies are continuously seeking fresh talent, making it an opportune time for recent graduates to enter the field.Prominent industries in Pune that are actively hiring financial analysts include:

- Information Technology: With many tech firms expanding their operations, there is a growing need for analysts who can help in financial planning and analysis of tech projects.

- Manufacturing: The manufacturing sector requires financial analysts to manage costs, optimize budgets, and ensure compliance with financial regulations.

- Banking and Financial Services: As Pune becomes a hub for financial services, banks and financial institutions are on the lookout for analysts to support investment and risk assessment functions.

- Pharmaceuticals: The pharmaceutical industry relies on financial analysts to evaluate research and development investments and monitor profitability.

- Startups: The rise of startups in Pune has created unique opportunities for analysts to provide strategic financial insights that shape business growth.

The combination of Pune’s economic development and the increasing complexity of financial markets ensures that the demand for skilled financial analysts will continue to rise, offering freshers a promising career path.

Qualifications and Skills Required

To thrive as a financial analyst in Pune, freshers must equip themselves with the right educational background and skill set. The financial sector is competitive, and employers often look for candidates who not only meet the educational requirements but also possess essential analytical skills. Having a solid foundation in finance and complementary skills can significantly enhance one’s employability.Educational qualifications typically serve as the bedrock for a career in financial analysis.

Most employers require candidates to have a bachelor’s degree in finance, accounting, economics, or a related field. This academic background imparts crucial knowledge about financial principles, investment strategies, and market dynamics.

Educational Qualifications

A degree in finance or a related discipline is fundamental for aspiring financial analysts. Here’s a breakdown of the key educational qualifications:

- Bachelor’s Degree in Finance: This degree is the most sought after by employers, as it covers essential topics like financial management, investment analysis, and corporate finance.

- Bachelor’s Degree in Accounting: Helps in understanding financial statements and accounting principles, which are vital for data analysis.

- Bachelor’s Degree in Economics: Provides insight into market behavior and economic theories, which are beneficial for forecasting and analysis.

- Master’s Degree in Finance or MBA: While not mandatory, having a master’s degree can provide a competitive edge and lead to higher-level opportunities.

Essential Skills for Financial Analysts

In addition to educational qualifications, possessing the right skills is crucial for succeeding in this role. Here are some essential skills that enhance employability in financial analysis:

- Analytical Skills: The ability to analyze complex data sets and draw meaningful insights is crucial. Financial analysts must be adept at interpreting data to make informed decisions.

- Proficiency in Financial Software: Knowledge of software such as Excel, SAP, or financial modeling tools can streamline analysis and improve efficiency.

- Communication Skills: Clear communication of complex financial concepts to non-financial stakeholders is essential for collaboration and presentation.

- Attention to Detail: Financial analysts must maintain a high level of accuracy and attention to detail to ensure that financial reports are precise and reliable.

Certification Programs

Pursuing additional certifications can significantly benefit aspiring financial analysts and make them stand out in the job market. Here are some popular certification programs that can enhance expertise and credibility:

- Chartered Financial Analyst (CFA): This globally recognized certification focuses on investment management and financial analysis, making it highly valuable in the finance industry.

- Financial Risk Manager (FRM): This certification is ideal for those looking to specialize in risk management and provides a comprehensive understanding of risk assessment and mitigation.

- Certified Public Accountant (CPA): A CPA designation is advantageous for financial analysts working closely with accounting principles and practices.

- Certified Management Accountant (CMA): This certification focuses on financial management skills, which are pivotal for strategic planning and decision-making.

Job Search Strategies for Freshers

As fresh graduates stepping into the competitive job market of Pune, it is essential to employ effective job search strategies to secure financial analyst positions. With numerous opportunities available, having a structured approach will enhance your visibility and increase your chances of landing a job.Identifying the right job portals and leveraging networking can significantly impact your job search. Below are key strategies tailored to help you navigate the landscape of financial analyst jobs in Pune effectively.

Job Portals and Websites for Financial Analyst Openings

Utilizing the right job portals is crucial for discovering financial analyst openings. Here’s a list of popular websites where you can find relevant job listings:

- Naukri.com – A leading job portal in India that offers a wide range of financial analyst roles.

- LinkedIn – Not only a networking platform but also hosts job listings tailored to your skills and interests.

- Indeed.com – A comprehensive job search engine that aggregates listings from various sources.

- Monster India – Offers a specific section for finance-related jobs, including analyst positions.

- Glassdoor – Provides insights along with job openings, allowing you to research potential employers.

- Shine.com – Focuses on freshers and entry-level positions, ideal for new graduates.

Networking Strategies for Fresh Graduates in Finance

Networking is a vital strategy for freshers aiming to break into the finance industry. Building relationships can lead to referrals and insider knowledge about job openings. Here are effective networking strategies to consider:

- Attend finance-related seminars and workshops to meet industry professionals.

- Join finance clubs or associations at your college to connect with peers and mentors.

- Leverage LinkedIn to connect with alumni from your university who work in finance.

- Participate in online forums and groups focused on financial analysis and job opportunities.

- Reach out to professionals for informational interviews to gain insights and advice.

Tips for Crafting an Effective Resume Tailored for Financial Analyst Positions

A well-crafted resume is essential for making a strong first impression on potential employers. Here are some tips to ensure your resume stands out:

- Use a clear and professional format that is easy to read.

- Highlight relevant coursework and projects that demonstrate your analytical skills.

- Incorporate s from the job description to make your resume more relevant.

- Quantify your achievements, showcasing specific results from your internships or projects.

- Include a summary statement that Artikels your career goals and what you bring to the table.

Interview Preparation Tips

Preparing for interviews as a financial analyst requires not only a solid understanding of financial principles but also the ability to effectively communicate your skills and experiences. Freshers must anticipate the kinds of questions they might face and prepare diligently to present case studies that demonstrate their analytical capabilities. Mastering these aspects of the interview process can significantly enhance your chances of securing a position.

Common Interview Questions for Financial Analyst Roles

Understanding the typical questions posed during interviews can help candidates become more comfortable and confident. Interviewers often assess both technical knowledge and soft skills. Here are some common areas of focus:

- Technical knowledge, including questions about financial modeling, valuation techniques, and financial statements.

- Behavioral questions aimed at assessing teamwork, conflict resolution, and decision-making processes.

- Scenario-based questions that require candidates to demonstrate their analytical thinking and problem-solving abilities.

Familiarizing yourself with these topics and practicing responses can make a significant difference in your performance during the interview.

Techniques to Prepare and Present Case Studies During Interviews

Case studies are frequently used in financial analyst interviews to assess a candidate’s practical application of their skills. Here are some techniques to effectively prepare and present your case studies:

- Understand the case study format: Familiarize yourself with different types of case studies commonly used in interviews, such as market analysis or financial forecasting.

- Practice with real-life examples: Analyze actual business cases or scenarios that can help you articulate your thought process clearly.

- Structure your response: Use a clear structure such as problem identification, analysis, and recommendations to present your case study logically.

- Engage with the interviewer: Encourage questions and discussions throughout your presentation to demonstrate your collaborative approach.

Utilizing these techniques can help you convey your analytical abilities effectively while highlighting your potential contribution to the organization.

Strategies for Showcasing Analytical Skills During the Interview Process

Demonstrating your analytical skills in an interview is crucial for a financial analyst role. Here are strategies that can help you effectively showcase these skills:

- Provide specific examples: Use concrete examples from your academic projects or internships where you applied analytical skills to solve problems.

- Quantify your achievements: Whenever possible, use metrics to quantify your impact, such as improvements in efficiency or accuracy in financial reporting.

- Demonstrate critical thinking: Share how you approach a problem, break it down into manageable parts, and analyze each component.

- Utilize data visualization: If applicable, mention tools you’ve used for data analysis and visualization, showcasing your technical proficiency.

These strategies can help you illustrate your analytical mindset and reinforce your suitability for the financial analyst position.

Salary Expectations and Growth Opportunities

The financial analyst role is a promising starting point for freshers entering the job market, particularly in Pune. With its burgeoning economy and a variety of industries, Pune offers competitive salaries for entry-level positions compared to other cities in India. Understanding salary expectations and growth opportunities is essential for fresh graduates aiming to make informed career choices.

Entry-Level Salaries for Financial Analysts

In Pune, entry-level financial analysts can expect a salary range typically between ₹3,00,000 to ₹6,00,000 per annum, depending on the company and the specific skills one possesses. This range is competitive when compared to other major cities like Mumbai and Bangalore, where entry-level salaries can start from ₹4,00,000 to ₹7,00,000 per annum. Factors such as the cost of living, demand for financial services, and the presence of multinational corporations contribute to these variations.

Potential Career Paths for Financial Analysts in Pune

Starting as a financial analyst opens the door to various career advancement paths. Here are some potential avenues:

- Senior Financial Analyst

- Financial Manager

- Investment Banking Analyst

- Risk Manager

- Corporate Finance Specialist

These roles not only enhance financial acumen but also offer managerial responsibilities, leading to higher salaries and leadership opportunities over time.

Factors Influencing Salary Growth in Financial Analysis Careers

Several key factors can significantly influence the salary growth of financial analysts:

- Experience: As analysts accumulate experience, their earning potential typically increases, with seasoned professionals earning upwards of ₹10,00,000 per annum.

- Education and Certifications: Additional qualifications like CFA or MBA can enhance job prospects and lead to salary increases.

- Industry Demand: Certain sectors, such as technology and finance, tend to offer higher salaries due to greater demand for skilled analysts.

- Networking: Building a professional network can lead to better job opportunities and salary negotiations.

By focusing on these areas, freshers can strategically position themselves for successful careers in financial analysis.

Professional Development and Networking

In the competitive field of financial analysis, continuous learning and effective networking play crucial roles in career advancement. Freshers can significantly enhance their skills and professional connections through various resources and organizations. This section explores essential avenues for professional growth and networking opportunities that can give freshers an edge in the job market.

Resources for Continuous Learning in Financial Analysis

Staying updated with the latest trends and techniques in financial analysis is essential. Several resources can help freshers enhance their knowledge and skills:

- Online Courses: Platforms like Coursera, Udemy, and LinkedIn Learning offer courses in financial modeling, statistical analysis, and Excel for finance. Certifications such as CFA (Chartered Financial Analyst) or CIMA (Chartered Institute of Management Accountants) are also beneficial.

- Webinars and Workshops: Many financial institutions and professional organizations offer free or low-cost webinars where experts share insights and practical knowledge.

- Books and Journals: Reading industry-relevant books and subscribing to financial journals keeps freshers informed about the latest research and methodologies in financial analysis.

Importance of Joining Professional Organizations

Becoming a member of professional organizations provides invaluable networking opportunities and access to industry resources. These organizations often host events, webinars, and conferences tailored to financial professionals.

- Networking Opportunities: Events organized by bodies such as the CFA Institute or local finance associations allow freshers to meet industry leaders and peers, facilitating connections that could lead to job opportunities.

- Access to Resources: Members often gain access to exclusive research reports, tools, and job boards, offering a competitive advantage in the job market.

- Mentorship Programs: Many organizations offer mentorship programs where freshers can receive guidance from experienced professionals, helping them navigate their careers more effectively.

Opportunities for Internships and Projects

Gaining practical experience through internships and projects is vital for freshers in financial analysis. These experiences not only enhance resumes but also provide real-world insights into the financial industry.

- Internships: Look for internship opportunities at financial firms, corporations, or startups that allow freshers to work alongside experienced analysts, gaining hands-on experience in financial modeling and analysis.

- College Projects: Engaging in finance-related projects during college can demonstrate analytical skills. Consider collaborating on projects that require financial forecasting or market analysis.

- Volunteering: Many nonprofits seek financial help. Providing pro bono services can enhance skills and expand networks while making a positive impact on the community.

Final Wrap-Up

In conclusion, the landscape of financial analyst jobs for freshers in Pune is filled with potential and growth. By equipping themselves with the necessary qualifications, honing their skills, and effectively navigating the job market, new graduates can embark on a rewarding career path in finance that promises both stability and advancement.

FAQ Resource

What qualifications do I need for a financial analyst job?

A degree in finance, accounting, or a related field is typically required, along with strong analytical skills.

Are certifications helpful for freshers in financial analysis?

Yes, certifications like CFA or CIMA can enhance your resume and demonstrate your commitment to the field.

How can I improve my chances of landing a financial analyst job?

Networking, internships, and tailoring your resume to highlight relevant skills are key strategies for freshers.

What are common interview questions for financial analysts?

Expect questions about financial modeling, data analysis, and scenario-based problem-solving.

What is the average salary for entry-level financial analysts in Pune?

The average salary ranges from INR 3 to 5 lakhs per annum, depending on the company and industry.

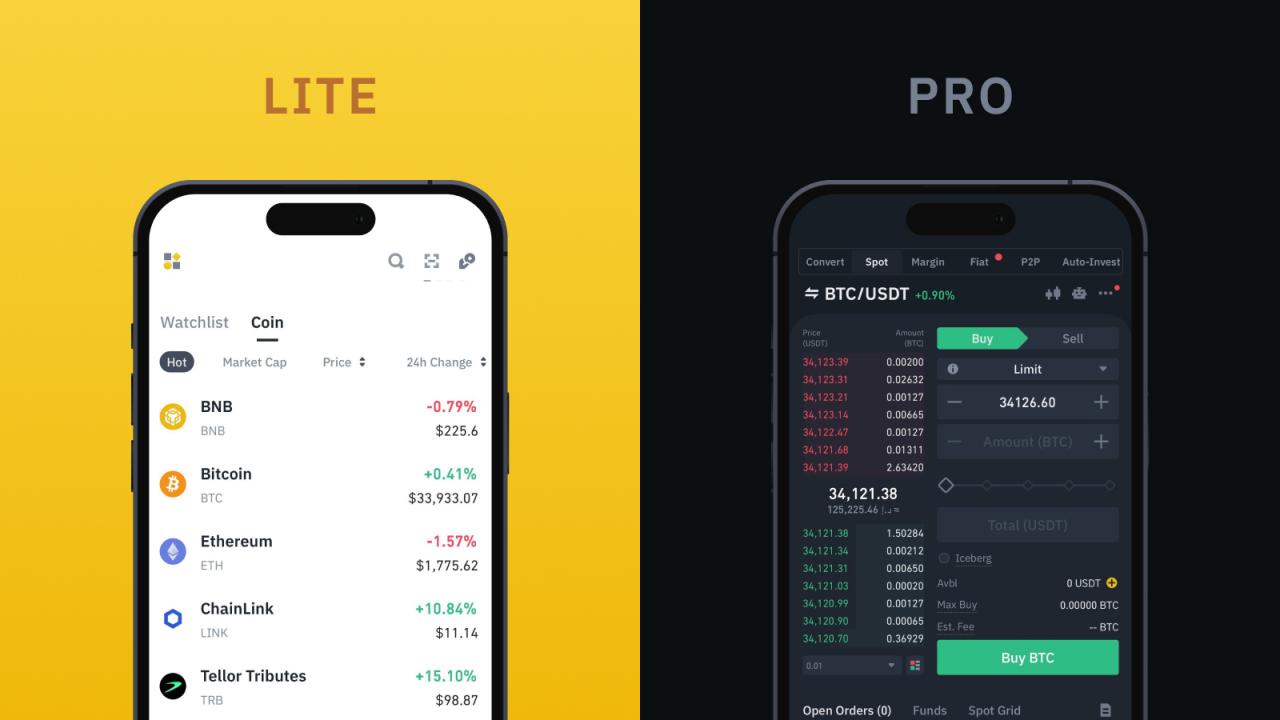

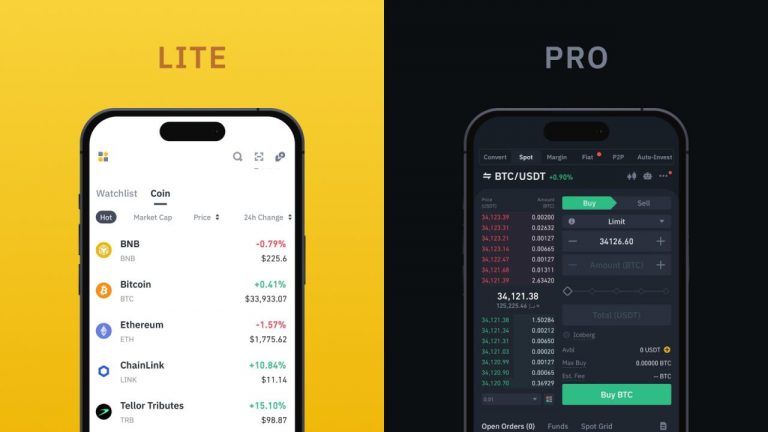

This image illustrates the trading pair section on the Binance app. You’ll see a display of the current price, volume traded, and other relevant information for Bitcoin. Next, you’ll need to select the amount of Bitcoin you wish to purchase.

This image illustrates the trading pair section on the Binance app. You’ll see a display of the current price, volume traded, and other relevant information for Bitcoin. Next, you’ll need to select the amount of Bitcoin you wish to purchase. This image depicts the input field where you specify the amount of Bitcoin you want to buy. Once you’ve entered the desired amount, review the total cost in your selected fiat currency.

This image depicts the input field where you specify the amount of Bitcoin you want to buy. Once you’ve entered the desired amount, review the total cost in your selected fiat currency. After review, confirm the purchase. The app will show a summary of the transaction, including the amount of Bitcoin, the total cost, and the relevant fees. Ensure all details are correct before confirming. Then, proceed with the payment.

After review, confirm the purchase. The app will show a summary of the transaction, including the amount of Bitcoin, the total cost, and the relevant fees. Ensure all details are correct before confirming. Then, proceed with the payment. This image displays a generic example of another platform’s Bitcoin purchase interface. The exact design will vary based on the platform’s user interface, but the essential elements—amount, cost, and confirmation—remain consistent.

This image displays a generic example of another platform’s Bitcoin purchase interface. The exact design will vary based on the platform’s user interface, but the essential elements—amount, cost, and confirmation—remain consistent. This image demonstrates the Binance app’s transaction history, providing a record of all Bitcoin transactions. This is critical for tracking your assets.

This image demonstrates the Binance app’s transaction history, providing a record of all Bitcoin transactions. This is critical for tracking your assets.