Crypto escrow companies are pivotal players in the cryptocurrency landscape, ensuring that transactions occur in a secure and trustworthy manner. By acting as neutral third parties, they facilitate the exchange between buyers and sellers, significantly reducing the risk of fraud and enhancing confidence in digital transactions.

These companies not only hold funds securely during the transaction process but also provide vital services such as dispute resolution and protection against scams. With the rise of cryptocurrency adoption, understanding the role and benefits of crypto escrow companies is more crucial than ever.

Overview of Crypto Escrow Companies

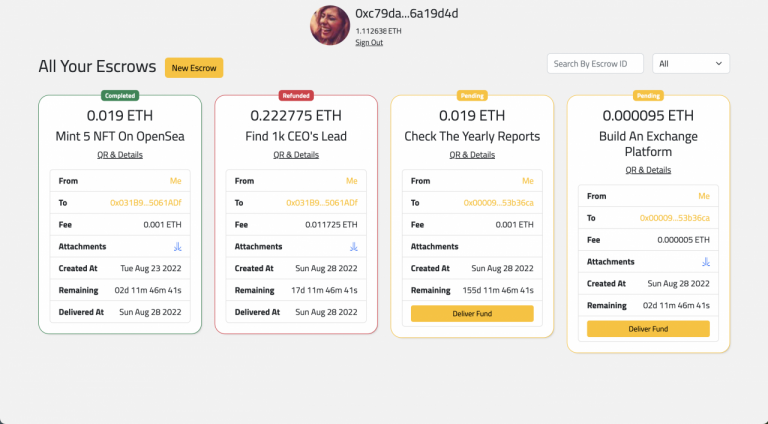

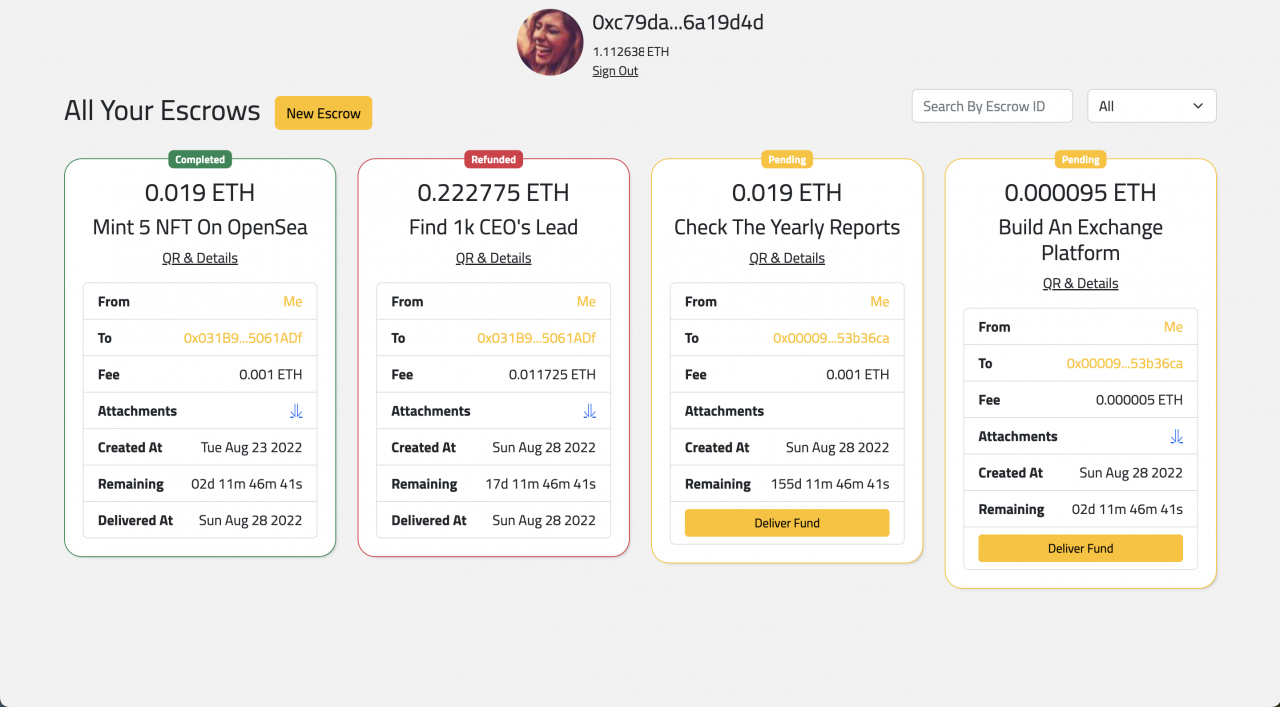

In the rapidly evolving world of cryptocurrency, escrow services have emerged as a crucial component that facilitates trust between buyers and sellers. The concept of crypto escrow revolves around a third-party service that holds funds during a transaction, ensuring that both parties fulfill their respective obligations before the release of those funds. This mechanism plays a significant role in mitigating risks associated with cryptocurrency transactions, which are often riddled with concerns of fraud and mistrust.Crypto escrow companies provide various essential services that enhance transaction security.

Their primary functions include holding the cryptocurrency in a secure environment until predefined conditions are met, verifying the identity of involved parties, and ensuring the safe transfer of assets. Notable examples of crypto escrow companies include Bitrated, Escrow.com, and LocalBitcoins, each offering unique features tailored to their users’ needs.

Benefits of Using Crypto Escrow Services

Utilizing crypto escrow services can dramatically enhance the safety and reliability of cryptocurrency transactions. By providing a neutral third-party service, these companies help to protect both buyers and sellers from potential scams and misunderstandings. The following advantages highlight why crypto escrow services are becoming indispensable in the crypto space:

- Increased Security: By holding funds in a secure escrow account, both parties can be assured that their assets are protected until the transaction is complete.

- Trust Building: Escrow services foster trust in transactions by ensuring that neither party has control over the funds until all conditions are satisfied.

- Dispute Resolution: Many escrow companies offer mediation services to help resolve conflicts that may arise during transactions.

How Crypto Escrow Works

Understanding the mechanics of crypto escrow transactions can demystify the process for new users. A typical transaction follows a straightforward step-by-step approach:

1. Agreement on Terms

The buyer and seller agree on the terms of the transaction, including price and delivery conditions.

2. Escrow Initiation

The buyer transfers the agreed amount of cryptocurrency to the escrow service.

3. Verification

The escrow service verifies the transaction and confirms that the funds are securely held.

4. Completion

Once the seller fulfills their part of the agreement (e.g., delivering the product or service), the escrow service releases the funds to the seller.

5. Dispute Handling

If any issues arise, the escrow service may mediate to resolve the conflict.A flowchart could illustrate the interactions between the buyer, seller, and escrow service, simplifying this process visually.

Choosing the Right Crypto Escrow Company

Selecting an appropriate crypto escrow service provider is critical for ensuring a secure transaction experience. Here are some key factors to consider:

- Reputation: Research the company’s background, read user reviews, and check for any complaints or scams reported.

- Fees: Compare the fee structures of different escrow services, as these can vary significantly and impact the overall cost of the transaction.

- Features: Evaluate the unique features offered by each company, such as automated services, customer support, and dispute resolution mechanisms.

The importance of user reviews cannot be overstated; they provide real-life insights into the experiences of others and can guide potential users in making informed decisions.

Legal and Regulatory Considerations

The legal landscape surrounding crypto escrow services is complex and varies significantly by jurisdiction. Companies must navigate a web of regulations to operate legally and protect their users:

Compliance

Crypto escrow companies must adhere to anti-money laundering (AML) and know your customer (KYC) regulations to avoid legal pitfalls.

Jurisdictional Variations

Different countries have different laws regarding cryptocurrencies, making it essential for companies to be aware of the legal frameworks in their operational areas.

Risks and Challenges

Regulatory compliance can be challenging; companies face risks such as changes in law, regulatory scrutiny, and potential legal action.

Future Trends in Crypto Escrow

The crypto escrow industry is poised for significant growth and transformation. Emerging trends indicate several potential developments:

Technological Advancements

Innovations in blockchain technology may lead to more robust and secure escrow services, enhancing user experiences.

Market Expansion

As cryptocurrency adoption increases, more businesses may begin utilizing escrow services, creating a larger market for providers.

Integration with Smart Contracts

The integration of smart contracts could automate and streamline escrow processes, reducing the need for human intervention and minimizing risks.Predictions suggest that as the crypto landscape evolves, escrow companies will adapt and innovate, fostering greater security and trust in cryptocurrency transactions.

Case Studies of Successful Crypto Escrow Transactions

Real-world examples of successful transactions facilitated by crypto escrow services illustrate their effectiveness. One notable case involved a high-value NFT sale, where an escrow service securely held the cryptocurrency until the digital art was transferred to the buyer. This transaction successfully demonstrated the trust and security that escrow services provide.Lessons learned from these case studies reveal the importance of clear communication between parties, the necessity of understanding the escrow process, and the benefits of using trusted services to mitigate risks.

Innovative practices, such as real-time tracking of transactions and automatic dispute resolution systems, have also emerged as best practices among successful escrow companies.

Final Thoughts

In summary, crypto escrow companies have emerged as essential facilitators in the world of cryptocurrency, providing security and peace of mind for all participants in the transaction process. As the industry evolves, these companies are likely to adopt new technologies and practices, further enhancing the trust and efficiency of digital transactions.

Frequently Asked Questions

What is a crypto escrow service?

A crypto escrow service is a third-party platform that holds cryptocurrency during a transaction to ensure security for both the buyer and seller until the terms are met.

How do I choose a reliable crypto escrow company?

Look for companies with good reputation, transparent fees, customer reviews, and strong security measures to protect your funds.

Are crypto escrow services legal?

Yes, crypto escrow services are legal in many jurisdictions, but it’s important to understand the local regulations and compliance requirements.

What happens if a dispute arises in a crypto escrow transaction?

The escrow service typically has a dispute resolution process in place to assess the situation and determine how to proceed, often involving mediation between the parties.

Can I cancel a transaction with a crypto escrow service?

Cancellation policies vary by escrow service; it’s advisable to check their specific terms and conditions regarding transaction cancellations.