Buying Bitcoin with an ATM card is becoming increasingly popular, offering a convenient alternative to traditional online exchanges. This guide explores the process, highlighting the advantages and disadvantages, and crucial security considerations.

From understanding the mechanics of Bitcoin ATMs to comparing them with other methods, we’ll cover all the essential aspects to make informed decisions. We’ll also touch upon the factors influencing transaction fees and the price of Bitcoin itself.

Introduction to Bitcoin ATM Transactions

Bitcoin ATMs are self-service kiosks that allow users to buy and sell Bitcoin (BTC) using fiat currency, typically via a credit or debit card. These ATMs are becoming increasingly popular as a convenient alternative to traditional online exchanges, offering a more accessible way to engage with the cryptocurrency market. They’re often found in public locations like shopping malls or convenience stores.The process typically involves inserting your ATM card, selecting the desired Bitcoin amount, and confirming the transaction.

The Bitcoin is then credited to your digital wallet address, which you’ll need to provide. These ATMs often provide real-time exchange rates, making it easy to understand the value of the Bitcoin being purchased.

Bitcoin ATM Transaction Process

The process of purchasing Bitcoin using an ATM card is straightforward. First, users select the amount of Bitcoin they wish to buy. Next, they enter their ATM card details, including the card number, expiry date, and CVV. The ATM will then display the equivalent fiat currency amount and the total transaction fees. Upon confirmation, the Bitcoin is credited to the user’s designated digital wallet.

Types of Bitcoin ATMs

Bitcoin ATMs come in various forms, ranging from small, countertop units to larger, freestanding models. Some models may also offer additional functionalities like hardware wallets or cryptocurrency-specific services. The types often differ in their transaction limits, available payment methods, and overall functionality.

Common Features of Bitcoin ATMs

Bitcoin ATMs generally share several key features. They usually display real-time Bitcoin prices and transaction fees, allowing users to make informed decisions. These kiosks also provide clear instructions and guides to ensure a user-friendly experience. Security measures are often incorporated to protect user data and transactions. Many support various fiat currencies and offer options to buy or sell Bitcoin.

Bitcoin ATM Transaction Fees

Transaction fees associated with Bitcoin ATM transactions vary significantly. The fees are typically dependent on several factors, including the specific ATM, the amount being traded, and the prevailing market conditions.

| Feature |

Description |

Typical Fee Structure |

| Transaction Fee |

A percentage or flat fee charged on the transaction amount. |

0.5% to 5% of the transaction value. |

| Network Fee |

A fee associated with processing the Bitcoin transaction on the blockchain. |

Variable, depending on network congestion. |

| ATM Fee |

A fixed fee charged by the Bitcoin ATM operator. |

Can range from $0 to $10. |

| Exchange Rate |

The rate at which Bitcoin is exchanged for fiat currency. |

Can vary slightly between different ATMs and even fluctuate during the transaction. |

Comparing Bitcoin ATM Purchases with Other Methods

Buying Bitcoin via ATMs presents a distinct alternative to traditional online exchanges. This method offers a degree of accessibility, particularly for individuals unfamiliar with online platforms or seeking a more immediate transaction. However, understanding the trade-offs between speed, cost, and security is crucial for making informed decisions.This comparison examines the process of purchasing Bitcoin with an ATM card versus online exchanges, highlighting the advantages, disadvantages, and potential risks involved in each approach.

The discussion also delves into security measures employed by reputable Bitcoin ATMs.

Process Comparison

Bitcoin ATM transactions typically involve inserting a debit or credit card, selecting the desired Bitcoin amount, and receiving the digital currency. Online exchanges, on the other hand, involve creating an account, verifying identity, depositing funds, and then selecting the cryptocurrency to purchase. The process for purchasing Bitcoin differs significantly between the two methods, impacting factors such as transaction time and user experience.

Advantages of Bitcoin ATMs

Bitcoin ATMs offer a convenient, physical alternative to online exchanges. Their accessibility, particularly in areas with limited internet access or a lack of familiarity with online platforms, is a key advantage. Furthermore, the instant nature of transactions can be appealing to those seeking immediate access to Bitcoin. This direct interaction can also facilitate a better understanding of the process for novice users.

Disadvantages of Bitcoin ATMs

Transaction fees at Bitcoin ATMs are generally higher than those associated with online exchanges. This difference is often significant and needs careful consideration. The availability of Bitcoin ATMs can also be limited, creating geographical constraints for users. Finally, the potential for scams or fraudulent activities associated with Bitcoin ATMs must be acknowledged.

Risks Associated with Bitcoin ATMs

Users must be vigilant about the security measures employed by the ATM provider. Unscrupulous operators might engage in fraudulent activities, leading to financial losses. A user’s lack of understanding about the platform’s security features or processes can also increase the risk. Furthermore, issues like technical malfunctions or human error during transactions can create problems.

Security Measures at Reputable Bitcoin ATMs

Reputable Bitcoin ATMs typically utilize robust security measures, including encryption for transactions, secure storage for funds, and fraud detection systems. These safeguards are vital in mitigating potential risks associated with using the ATM. These measures, combined with a user’s own diligence, can contribute to a more secure transaction.

Comparison Table

| Feature |

Bitcoin ATM |

Online Exchange |

| Speed |

Generally faster (instantaneous) |

Variable (depends on verification, network congestion) |

| Cost |

Higher transaction fees |

Lower transaction fees (often) |

| Security |

Depends on the ATM’s reputation and security measures |

Generally more secure platforms with robust security protocols |

| Accessibility |

Often more geographically accessible |

Usually requires internet access and account setup |

Factors Influencing Bitcoin ATM Transactions

Bitcoin ATMs, a convenient alternative for buying and selling Bitcoin, are influenced by various factors. Their accessibility, regulatory landscape, transaction costs, and the fluctuating price of Bitcoin all play a crucial role in shaping their usage and overall appeal. Understanding these factors is key to making informed decisions about utilizing this method of cryptocurrency acquisition.

Geographic Availability of Bitcoin ATMs

Bitcoin ATM distribution varies significantly across the globe. Availability is often concentrated in urban areas with higher cryptocurrency adoption rates, while rural regions may have limited or no access. This disparity in geographic coverage can create a barrier to entry for some potential users, particularly in less populated areas. Factors like population density, economic activity, and the local cryptocurrency community influence the decision to install an ATM.

This uneven distribution is a significant consideration for users seeking a convenient method for acquiring Bitcoin.

Impact of Regulations on Bitcoin ATM Operations

Regulations surrounding Bitcoin ATMs vary considerably across jurisdictions. Some regions have clear frameworks governing their operation, including licensing requirements, transaction limits, and reporting obligations. Other areas have less defined regulations, potentially creating uncertainty and operational challenges for businesses. These regulations can significantly influence the proliferation and operation of Bitcoin ATMs, affecting their presence in specific markets. Stricter regulations can lead to fewer ATMs in certain regions, while more lenient rules can result in increased availability.

Transaction Fees

Transaction fees charged by Bitcoin ATMs are typically determined by a combination of factors, including the amount being transacted, the network fees associated with Bitcoin transactions, and the ATM operator’s markup. Lower transaction amounts often correlate with higher fees, as a percentage of the transaction. Bitcoin network congestion can also affect transaction fees. Operators may also implement tiered pricing models, where higher transaction volumes are associated with reduced fees per unit.

Factors Influencing the Price of Bitcoin

The price of Bitcoin is a complex and dynamic variable, influenced by numerous factors. Market sentiment, news events, regulatory changes, and technological advancements all play a significant role in the price fluctuations. Investor confidence and speculation also significantly impact the price. Examples include large-scale adoption by institutional investors or significant announcements related to the Bitcoin network. A strong correlation exists between Bitcoin’s price and its overall perception within the financial and technological spheres.

Locating Nearby Bitcoin ATMs

Several methods exist for locating nearby Bitcoin ATMs. Online search engines, such as Google or DuckDuckGo, can provide listings of ATMs in a specific geographic area. Specialized Bitcoin ATM locator websites and mobile applications are also available. These resources typically display ATM locations, transaction limits, and potentially the current exchange rate for Bitcoin at the ATM. Using these tools will save you valuable time and effort in identifying ATMs near your location.

Buying Bitcoin in General

Purchasing Bitcoin, a digital currency, involves several steps and methods. Understanding these processes is crucial for anyone looking to acquire Bitcoin. This section details the general procedures and available platforms, enabling informed decisions about acquiring this cryptocurrency.Acquiring Bitcoin, regardless of the chosen method, typically involves a series of steps that need careful attention. These steps, while potentially varying slightly depending on the platform, generally follow a similar pattern.

General Steps in Buying Bitcoin

The process of purchasing Bitcoin usually involves these steps:

- Account Creation: Setting up an account on a cryptocurrency exchange or platform is the first step. This often requires providing personal information and completing verification procedures.

- Funding the Account: Depositing funds into the account using various methods like bank transfers, credit/debit cards, or other payment options is necessary. The exchange typically has instructions on how to proceed.

- Placing the Order: Users then select the amount of Bitcoin they want to buy and specify the desired price. This often involves using a market order or a limit order, which sets a desired price.

- Confirmation and Execution: Once the order is placed, the exchange verifies the order. If the order is approved and executed, the Bitcoin will be credited to the user’s account.

- Bitcoin Wallet: Storing Bitcoin requires a wallet. These wallets can be online or offline. Users need to securely store the private keys associated with their Bitcoin holdings.

Different Platforms and Services for Buying Bitcoin

Several platforms and services facilitate Bitcoin purchases. These platforms vary in features, fees, and security measures. A crucial aspect is the ease of use and available payment methods.

- Cryptocurrency Exchanges: Exchanges like Coinbase, Kraken, Binance, and Gemini are popular platforms for buying and selling Bitcoin. They often offer advanced trading features and a wide range of payment options.

- Bitcoin ATMs: Bitcoin ATMs provide a convenient, although often less cost-effective, way to purchase Bitcoin using cash or debit/credit cards. They are prevalent in many locations but may have higher fees.

- Brokerages: Some traditional brokerages are integrating cryptocurrency trading, allowing users to buy and sell Bitcoin through their existing accounts. This often simplifies the process for those already familiar with brokerage services.

- Peer-to-Peer (P2P) Platforms: P2P platforms connect buyers and sellers directly, offering potentially lower fees than exchanges. However, buyers need to exercise caution when dealing with unknown sellers.

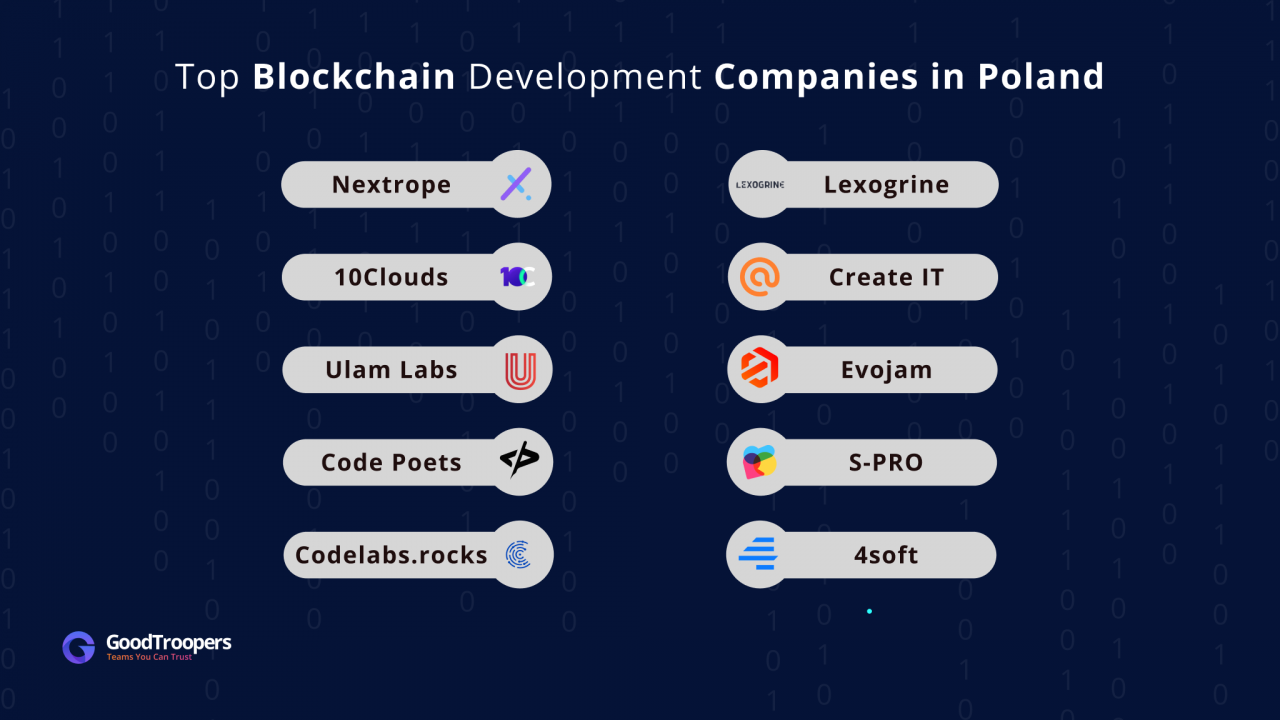

Top Bitcoin Exchanges

Bitcoin exchanges are platforms facilitating the trading of Bitcoin. A range of options exists, each with its strengths and weaknesses. Consider factors like fees, security, and available features when choosing.

- Coinbase: A popular exchange known for its user-friendly interface and strong security measures.

- Binance: A large exchange with a wide range of cryptocurrencies and advanced trading tools, although potentially more complex for beginners.

- Kraken: A reputable exchange offering a robust platform with advanced trading options.

- Gemini: Known for its security features and emphasis on compliance with regulations.

- Bitstamp: A well-established European exchange.

Comparison of Bitcoin Wallets

Bitcoin wallets store the private keys associated with Bitcoin ownership. Choosing the right wallet is essential for security. Various types exist, each with its own pros and cons.

| Wallet Type |

Description |

Pros |

Cons |

| Desktop Wallets |

Software installed on a computer. |

High security, full control |

Requires computer storage |

| Mobile Wallets |

Software for smartphones. |

Convenience, accessibility |

Security depends on device security |

| Online Wallets |

Stored on a platform. |

Ease of access, no storage needed |

Security relies on the platform |

| Hardware Wallets |

Dedicated physical devices. |

High security, offline storage |

More expensive, can be complex to set up |

Security and Privacy Concerns

Using Bitcoin ATMs for transactions presents unique security and privacy considerations. While Bitcoin ATMs offer convenience, users must be aware of potential risks and take proactive steps to protect their funds and personal information. Understanding these risks and employing appropriate security measures is crucial for a safe and secure Bitcoin buying experience.

Potential Security Risks

Bitcoin ATMs, like any financial technology, are susceptible to various security risks. These range from physical theft of the ATM itself to software vulnerabilities that could compromise user data. Malicious actors could potentially manipulate the system to provide inaccurate exchange rates or misappropriate funds. Critically, ATMs without proper security protocols might be targeted for hacking or physical attacks.

The integrity of the Bitcoin ATM’s software and hardware is paramount for secure transactions.

Protecting Personal Information

Protecting personal information is paramount when interacting with any financial system. Using strong, unique passwords and enabling two-factor authentication (2FA) on your Bitcoin wallet and any associated accounts is essential. Avoid using public Wi-Fi networks for transactions, as they are susceptible to eavesdropping. Ensure the ATM’s security protocols are robust and comply with industry standards. Carefully review all transaction details before confirming any purchase.

Choosing Reputable Bitcoin ATMs

Selecting reputable Bitcoin ATMs is crucial for safeguarding transactions. Look for ATMs that have clear operational licenses and regulatory compliance. Research the ATM’s reputation through online reviews and forums. A high volume of positive feedback and verifiable information about the operator can provide confidence in the ATM’s legitimacy. Verify the ATM’s location and ensure it is not in a high-crime area.

Spotting Fraudulent Bitcoin ATMs

Fraudulent Bitcoin ATMs are a significant concern. Look for unusual or inconsistent pricing structures, and do not hesitate to verify the exchange rate with other legitimate sources. Suspicious ATM designs, or a lack of physical security measures like cameras, raise red flags. Unusually low transaction limits or inconsistent customer service can indicate a fraudulent operation. Verify the ATM’s legitimacy by contacting the vendor directly or checking online for their operating licenses.

Tips for Staying Safe

| Category |

Tips |

| Transaction Verification |

Verify the transaction details before confirming any purchase, including the exchange rate and the amount. |

| ATM Selection |

Choose ATMs with positive reviews and verified operational licenses. Research the ATM’s reputation through online reviews and forums. |

| Personal Information Protection |

Use strong, unique passwords and enable two-factor authentication (2FA) on your Bitcoin wallet and any associated accounts. Avoid using public Wi-Fi networks. |

| Transaction Environment |

Ensure the ATM is in a well-lit and secure location. Avoid using ATMs in high-crime areas or poorly maintained locations. |

| Fraud Awareness |

Be wary of unusual or inconsistent pricing structures. Verify the exchange rate with other legitimate sources. Look for suspicious ATM designs or a lack of security measures. |

Future Trends and Developments

The Bitcoin ATM market is experiencing dynamic growth, driven by increasing user adoption and technological advancements. Predicting the future trajectory requires careful consideration of emerging trends and potential challenges. Understanding the evolving landscape will help investors and operators alike make informed decisions.

Potential Growth of Bitcoin ATM Networks

The future growth of Bitcoin ATM networks hinges on several factors, including regulatory clarity, expanding user base, and strategic partnerships. Increased accessibility and user-friendliness are key to driving wider adoption. Success stories in specific geographic regions, such as the burgeoning Bitcoin ATM presence in certain European cities, suggest a potential for exponential growth in underserved markets.

Impact of Technological Advancements

Technological advancements are reshaping the Bitcoin ATM experience. Improved user interfaces and faster transaction processing times are enhancing the overall user experience. Biometric authentication, for instance, could significantly enhance security and streamline the buying process, reducing the risk of fraudulent transactions. The integration of mobile wallets and QR codes further facilitates seamless transactions, allowing users to access Bitcoin ATMs without physical cash.

Integration with Other Payment Systems

The future of Bitcoin ATMs likely involves integration with existing payment systems. This could include linking to bank accounts or debit cards, potentially offering users more convenient and diverse options for purchasing Bitcoin. Such integrations would expand the user base and increase the functionality of Bitcoin ATMs, creating a more comprehensive payment ecosystem. Examples of similar integrations in other sectors, like mobile payment systems connecting to various retail stores, illustrate the potential for this development.

Challenges and Opportunities for Bitcoin ATM Operators

Bitcoin ATM operators face challenges such as maintaining security, navigating regulatory landscapes, and managing evolving customer expectations. However, these challenges also present opportunities. Adapting to new technologies, partnering with financial institutions, and focusing on education and awareness campaigns can help operators stay ahead of the curve. Furthermore, developing unique value propositions, such as specialized services like Bitcoin-to-fiat conversions, could help differentiate and attract specific user segments.

Forecast of Bitcoin ATM Usage

Predicting Bitcoin ATM usage in the coming years is challenging, but several factors suggest a continued upward trend. Increased global cryptocurrency adoption and the expanding reach of Bitcoin ATMs in emerging markets indicate a potential surge in user activity. For example, the growing popularity of Bitcoin in developing economies highlights a likely increase in the use of Bitcoin ATMs as a method for purchasing Bitcoin, which might be more accessible or more convenient than other methods.

The integration of new technologies and a more favorable regulatory environment will likely contribute to a significant increase in Bitcoin ATM usage over the next few years.

User Experiences and Reviews

User experiences with Bitcoin ATMs play a crucial role in shaping the perception and adoption of this technology. Positive and negative feedback provides valuable insights into the strengths and weaknesses of Bitcoin ATM services, influencing future development and improvement. Understanding these experiences helps potential users make informed decisions and contributes to a more robust and user-friendly ecosystem.

Common User Experiences

User experiences with Bitcoin ATMs vary significantly, ranging from seamless transactions to frustrating difficulties. Some users find the process straightforward and convenient, while others encounter challenges related to the ATM’s interface, fees, or overall functionality. The user experience is often influenced by the specific ATM location, the supporting platform, and the individual user’s technical proficiency.

Positive User Experiences

Many users report positive experiences with Bitcoin ATM transactions, highlighting the convenience of buying Bitcoin without needing a bank account or traditional financial intermediaries. The ability to buy and sell Bitcoin quickly and directly is frequently cited as a significant advantage. Some users appreciate the 24/7 availability and accessibility of Bitcoin ATMs, providing flexibility for transactions at any time.

- Fast and straightforward transactions are frequently praised, especially when compared to traditional methods of purchasing cryptocurrencies.

- The ease of use for those with basic technical skills is a positive aspect.

- The accessibility of Bitcoin ATMs, especially in areas with limited traditional banking options, is often seen as a benefit.

Negative User Experiences

While positive experiences are prevalent, negative experiences also exist. Common issues include ATM malfunction, long transaction times, high fees, and difficulties with the ATM’s user interface. Some users report inconsistencies in pricing and the lack of clarity regarding fees, leading to confusion and frustration.

- Technical issues, such as ATM malfunctions or slow transaction speeds, are frequently reported as negative experiences.

- High transaction fees are a recurring concern, particularly when compared to other purchasing methods.

- Limited accessibility, such as ATM location constraints or technical limitations, can create problems for some users.

User Feedback Importance

User feedback is crucial for improving Bitcoin ATM services. Understanding the common issues and concerns expressed by users allows developers and operators to identify areas for improvement. By actively collecting and analyzing user feedback, Bitcoin ATM services can enhance the overall user experience, leading to increased adoption and trust.

Categorized User Feedback

| Category |

Positive Experiences |

Negative Experiences |

| Transaction Speed |

Fast, quick transactions |

Slow, lengthy transactions |

| Fees |

Clear, transparent pricing |

Hidden fees, high transaction costs |

| User Interface |

Intuitive, easy-to-use interface |

Complex, confusing interface |

| ATM Functionality |

Reliable, functional ATMs |

Malfunctioning ATMs, technical issues |

| Accessibility |

Convenient location |

Limited location availability |

Ending Remarks

In conclusion, buying Bitcoin with an ATM card provides a tangible and accessible way to enter the cryptocurrency market. While convenience and ease of use are key advantages, understanding the associated risks and choosing reputable ATMs are paramount. Ultimately, the decision to use this method depends on your individual needs and risk tolerance. Further research and due diligence are always recommended.

Detailed FAQs

What are the typical transaction fees for Bitcoin ATM purchases?

Transaction fees vary significantly between different Bitcoin ATM providers. Fees are often a percentage of the transaction amount, and factors like the specific ATM, volume of transactions, and location can all influence the final cost.

What are the security measures I should look for in a reputable Bitcoin ATM?

Reputable Bitcoin ATMs typically employ advanced security measures, including encryption, secure transactions, and physical security to protect your personal information and funds. Look for ATMs with clear security policies and customer reviews.

How do I locate nearby Bitcoin ATMs?

Various online resources and mobile apps allow you to search for Bitcoin ATMs in your area. Many providers also have their own locator tools on their websites.

Are there any special considerations for users in different regions?

Geographic regulations and laws regarding Bitcoin transactions can vary significantly. Users in different regions may encounter varying levels of acceptance and accessibility of Bitcoin ATMs.

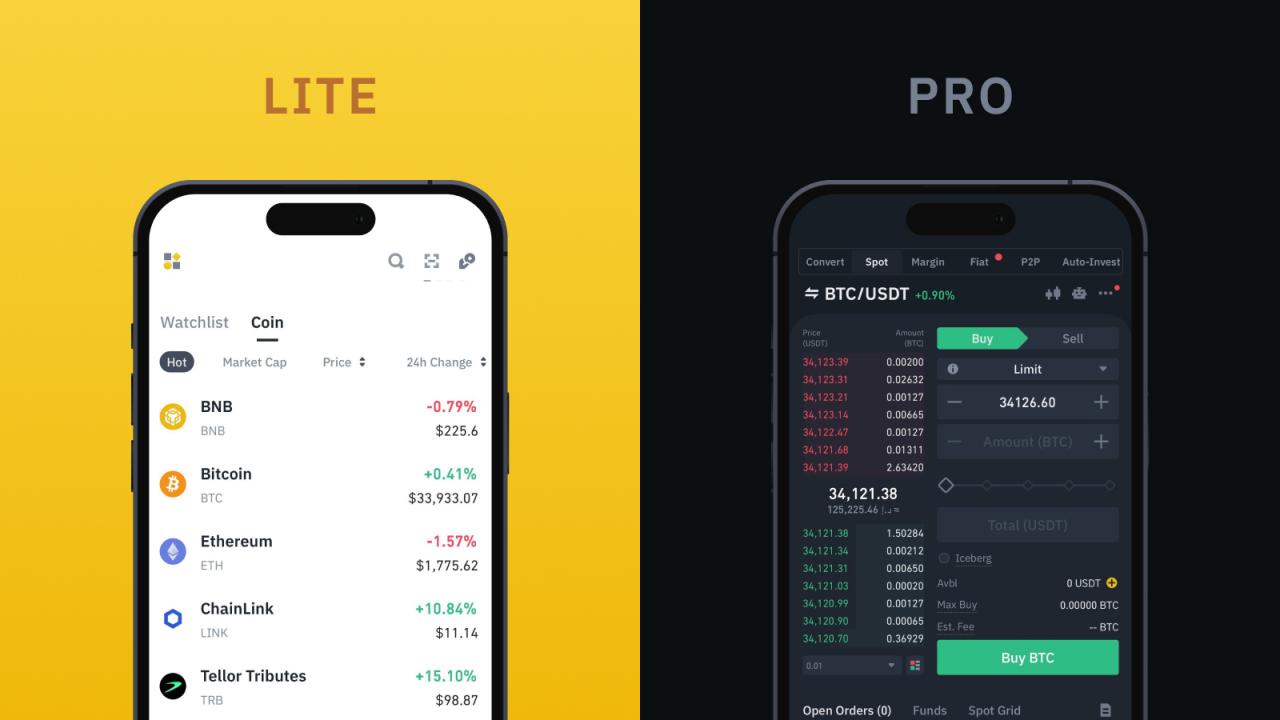

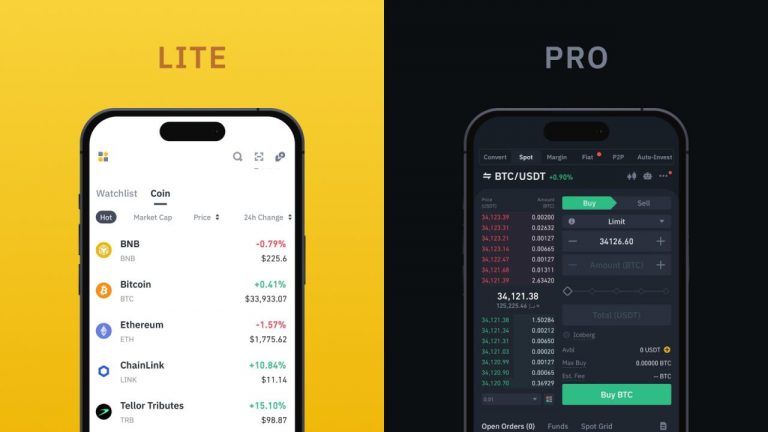

This image illustrates the trading pair section on the Binance app. You’ll see a display of the current price, volume traded, and other relevant information for Bitcoin. Next, you’ll need to select the amount of Bitcoin you wish to purchase.

This image illustrates the trading pair section on the Binance app. You’ll see a display of the current price, volume traded, and other relevant information for Bitcoin. Next, you’ll need to select the amount of Bitcoin you wish to purchase. This image depicts the input field where you specify the amount of Bitcoin you want to buy. Once you’ve entered the desired amount, review the total cost in your selected fiat currency.

This image depicts the input field where you specify the amount of Bitcoin you want to buy. Once you’ve entered the desired amount, review the total cost in your selected fiat currency. After review, confirm the purchase. The app will show a summary of the transaction, including the amount of Bitcoin, the total cost, and the relevant fees. Ensure all details are correct before confirming. Then, proceed with the payment.

After review, confirm the purchase. The app will show a summary of the transaction, including the amount of Bitcoin, the total cost, and the relevant fees. Ensure all details are correct before confirming. Then, proceed with the payment. This image displays a generic example of another platform’s Bitcoin purchase interface. The exact design will vary based on the platform’s user interface, but the essential elements—amount, cost, and confirmation—remain consistent.

This image displays a generic example of another platform’s Bitcoin purchase interface. The exact design will vary based on the platform’s user interface, but the essential elements—amount, cost, and confirmation—remain consistent. This image demonstrates the Binance app’s transaction history, providing a record of all Bitcoin transactions. This is critical for tracking your assets.

This image demonstrates the Binance app’s transaction history, providing a record of all Bitcoin transactions. This is critical for tracking your assets.