Delving into the future of crypto, this exploration examines the potential trajectories of the cryptocurrency market. From the underlying blockchain technology to evolving regulations, we’ll dissect the key factors shaping the crypto landscape.

This analysis considers a range of variables, including economic shifts, technological advancements, and institutional involvement. The discussion also addresses the crucial role of public perception and regulatory environments in shaping future trends. Potential risks and opportunities within the crypto space will be evaluated, along with illustrative examples of past predictions to gain insights into the market’s volatility.

Overview of Cryptocurrency Market

Cryptocurrencies have rapidly evolved from a niche concept to a global phenomenon, impacting various sectors and financial markets. Their decentralized nature and potential for disruptive innovation have attracted both enthusiastic supporters and cautious skeptics. This overview delves into the history, types, underlying technology, and categorization of cryptocurrencies, providing a comprehensive understanding of their current landscape.The crypto market is characterized by volatility and rapid changes.

Understanding its historical context, technological underpinnings, and diverse forms is crucial for navigating this dynamic environment.

History of Cryptocurrency

The concept of cryptocurrency emerged in the early 2000s, with the seminal invention of Bitcoin in 2009. This marked the beginning of a new era in digital finance, challenging traditional financial systems and inspiring the development of numerous other cryptocurrencies. Key milestones include the creation of alternative cryptocurrencies like Ethereum, Litecoin, and Ripple, each with distinct features and purposes.

Further development involved the emergence of decentralized exchanges (DEXs) and the growing adoption of cryptocurrencies in various sectors. These milestones reflect the increasing interest and investment in the crypto market.

Types of Cryptocurrencies

Cryptocurrencies can be categorized based on their specific characteristics and functions. Bitcoin, for example, is a decentralized digital currency, designed to facilitate peer-to-peer transactions. Ethereum, a platform for decentralized applications (dApps), enables the creation of smart contracts and other innovative functionalities. Stablecoins, designed to maintain a stable value pegged to traditional currencies like the US dollar, address concerns about price volatility.

Underlying Technology: Blockchain

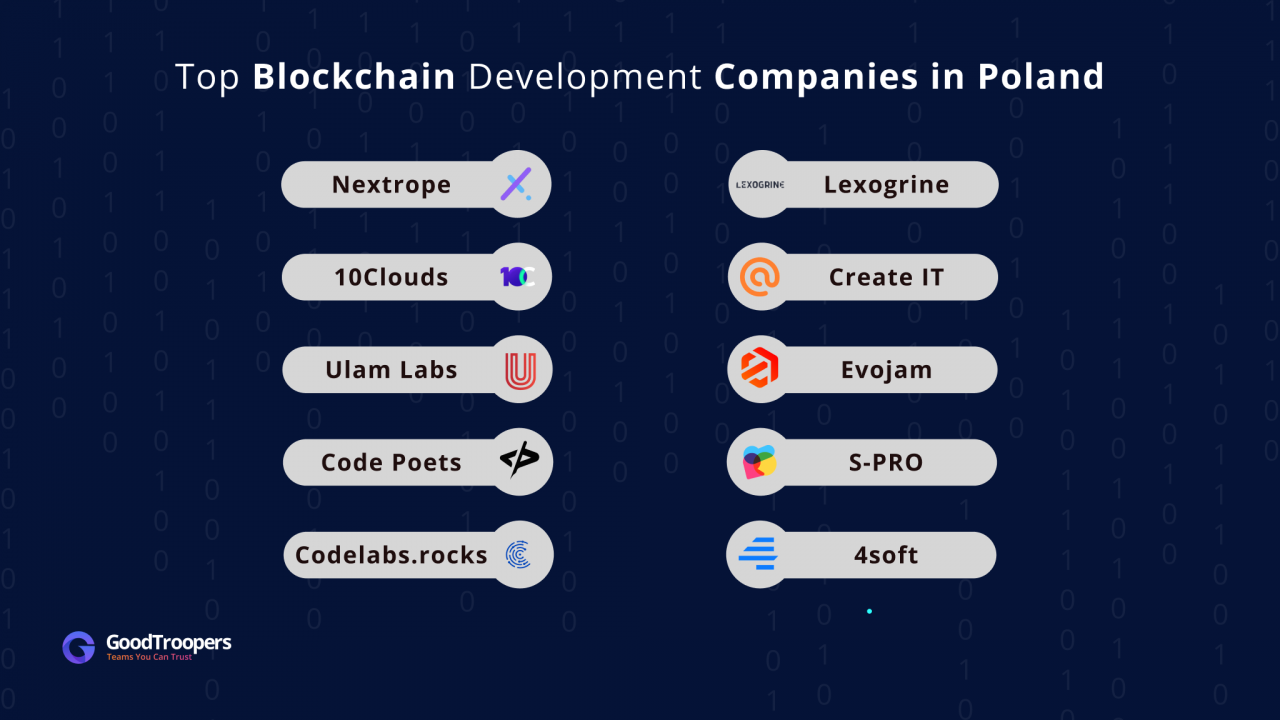

Blockchain technology forms the foundation of most cryptocurrencies. It’s a distributed, immutable ledger that records transactions across a network of computers. This decentralized nature enhances security and transparency, distinguishing it from traditional financial systems. Blockchain’s potential applications extend beyond cryptocurrencies, encompassing supply chain management, voting systems, and digital identity verification.

Categorization of Cryptocurrencies

Cryptocurrencies can be grouped into various categories based on their purpose, use case, and market capitalization. Some cryptocurrencies focus on facilitating transactions, while others serve as platforms for decentralized applications. The market capitalization, reflecting the total value of a cryptocurrency, is often used to categorize its prominence and influence in the market. The diverse range of cryptocurrencies reflects the evolving nature of the digital economy and its applications.

Top 5 Cryptocurrencies by Market Capitalization

| Cryptocurrency |

Market Share (approximate) |

Price Fluctuation (Past Year) |

| Bitcoin (BTC) |

Around 40-50% |

Significant fluctuations, with periods of substantial price increases and declines. |

| Ethereum (ETH) |

Around 15-20% |

Similar volatility to Bitcoin, with notable price swings throughout the year. |

| Tether (USDT) |

Around 5-10% |

Relatively stable, aiming to maintain a peg to the US dollar. |

| Binance Coin (BNB) |

Around 5-10% |

Significant fluctuations, influenced by exchange activities and market trends. |

| Solana (SOL) |

Around 2-5% |

High volatility, reflecting the dynamic nature of the blockchain and associated applications. |

The table above presents a simplified comparison of the top 5 cryptocurrencies by market capitalization, highlighting their market share and price fluctuations. These figures are approximate and subject to change due to the highly dynamic nature of the crypto market. The market share and price fluctuations reflect the relative importance and price sensitivity of each cryptocurrency.

Factors Influencing Future Crypto Market Trends

The cryptocurrency market is a dynamic landscape shaped by a multitude of interwoven factors. Understanding these forces is crucial for navigating the ever-evolving terrain and anticipating potential future market trends. From economic shifts to regulatory landscapes and technological advancements, a complex interplay dictates the path of cryptocurrencies.The future trajectory of the crypto market hinges on how these diverse factors interact and evolve.

A robust understanding of these influences empowers investors and stakeholders to make informed decisions and anticipate market reactions. This analysis will delve into the key drivers impacting the crypto market, including economic conditions, regulatory frameworks, technological innovation, and societal acceptance.

Major Economic Factors

Economic conditions play a pivotal role in shaping cryptocurrency prices and adoption. Interest rate hikes, inflation, and recessionary pressures can significantly impact investor sentiment and market valuations. For instance, during periods of economic uncertainty, some investors may seek refuge in cryptocurrencies, potentially boosting prices. Conversely, economic downturns often lead to decreased investor confidence, causing a pullback in the market.

Furthermore, the correlation between traditional financial markets and crypto markets remains a key observation point.

Regulatory Developments

Regulatory developments profoundly influence the future of cryptocurrencies. Varying regulatory approaches across countries create a complex landscape for crypto businesses and investors. A clear and consistent regulatory framework can foster trust and encourage wider adoption, while inconsistent or overly restrictive regulations can stifle innovation and limit participation.

Technological Advancements

Technological advancements continually reshape the crypto market. The emergence of new consensus mechanisms, improved scalability solutions, and enhanced security protocols can drive innovation and adoption. The development of decentralized finance (DeFi) applications and non-fungible tokens (NFTs) exemplifies the transformative potential of blockchain technology.

Potential Future Uses of Blockchain Technology

Beyond cryptocurrencies, blockchain technology holds promise for various applications. Supply chain management, voting systems, and digital identity are just a few areas where blockchain’s decentralized and secure nature can streamline processes and enhance transparency. The practical implementation of these use cases will be critical in determining the broader impact of blockchain.

Impact of Institutional Investment and Mainstream Adoption

Institutional investment and mainstream adoption are vital drivers of crypto market trends. Increased participation by large institutional investors, such as pension funds and hedge funds, can inject substantial capital into the market, potentially driving up prices. Furthermore, mainstream adoption, where cryptocurrencies become more integrated into everyday financial transactions, can significantly broaden the user base and enhance the overall market’s viability.

Role of Social Media and Public Opinion

Social media and public opinion play a significant role in shaping crypto adoption. Positive narratives and influential figures can generate excitement and attract new users. Conversely, negative press or controversies can lead to a downturn in investor sentiment and market valuations. The interplay between social media trends and market dynamics is a critical aspect to observe.

Comparison of Regulatory Environments

Regulatory environments vary significantly across different countries. Some countries have embraced crypto with favorable regulations, while others have taken a more cautious or restrictive approach. This divergence creates differing opportunities and challenges for crypto businesses and investors, requiring a nuanced understanding of the regulatory landscape in specific jurisdictions.

Potential Regulatory Scenarios and Their Impact

| Regulatory Scenario |

Likely Impact on Crypto Market Trends |

| Favorable Regulations |

Increased investor confidence, greater adoption, potential price appreciation. |

| Restrictive Regulations |

Reduced investor participation, stifled innovation, potential price volatility. |

| Ambiguous Regulations |

Uncertainty and hesitancy among investors, hindering widespread adoption, potential price fluctuations. |

| Progressive Regulations |

Gradual integration of crypto into mainstream finance, encouraging innovation, potentially boosting adoption and value. |

Potential Crypto Market Trends

The cryptocurrency market is a dynamic and rapidly evolving landscape. Predicting future trends is challenging, but analyzing current market forces and technological advancements provides a framework for informed speculation. Understanding potential trajectories in trading volume, adoption, blockchain applications, security, and the impact of emerging technologies like AI is crucial for navigating this space.

Potential Future Trends in Cryptocurrency Trading Volumes and Market Capitalization

The volume and market capitalization of cryptocurrencies are highly susceptible to market sentiment, regulatory developments, and technological breakthroughs. A significant increase in institutional investment, coupled with growing mainstream adoption, could drive substantial growth in both metrics. Conversely, regulatory uncertainty, security breaches, or market corrections could lead to declines. Past examples include the dramatic price fluctuations of Bitcoin and other major cryptocurrencies, which demonstrate the volatility inherent in this space.

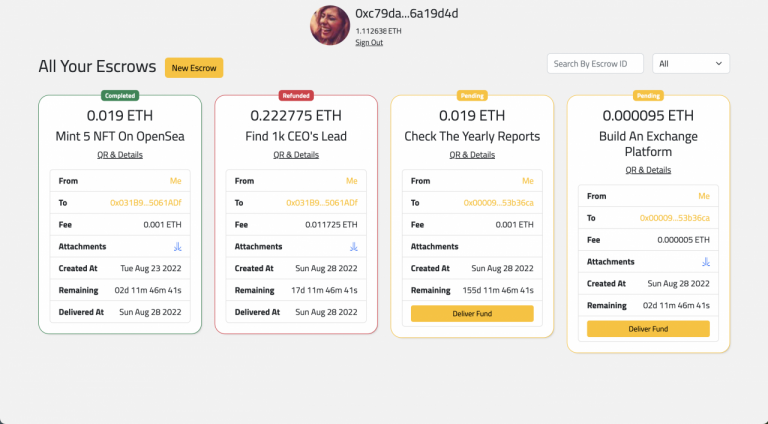

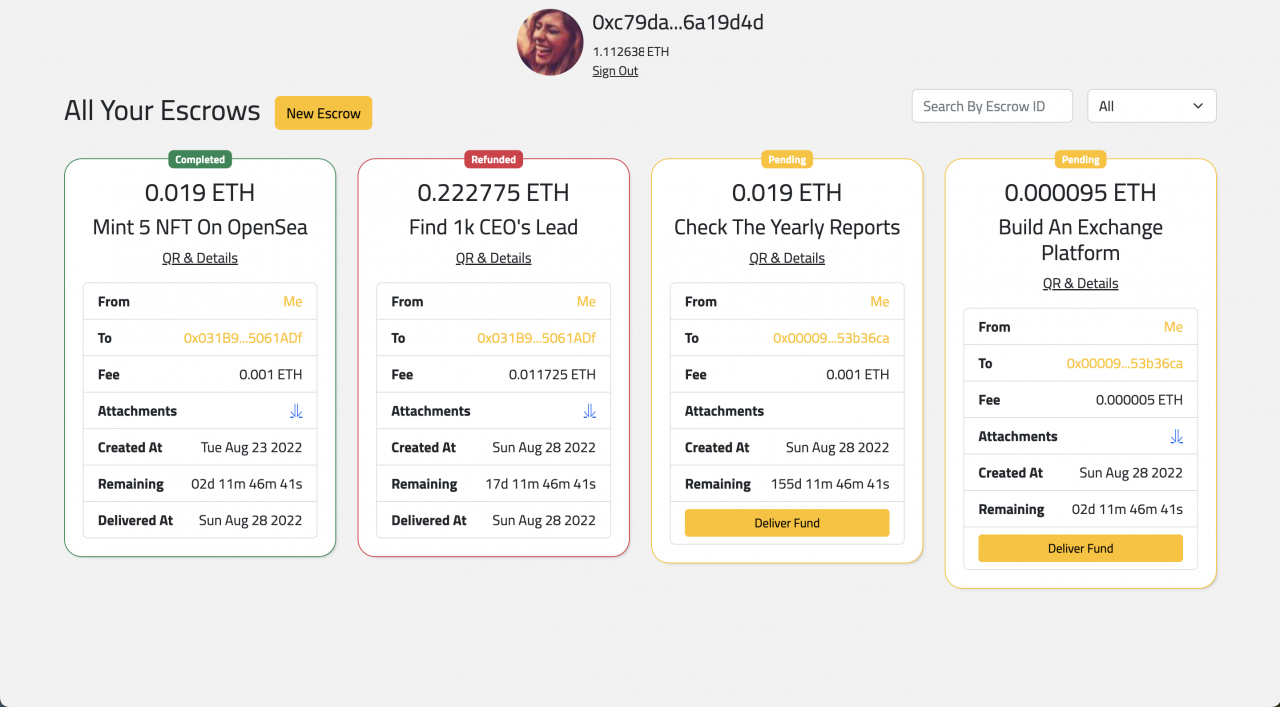

Possible Future Developments in the Adoption of Cryptocurrencies for Everyday Transactions

The integration of cryptocurrencies into everyday transactions is contingent on factors like user-friendliness, transaction speeds, and regulatory clarity. Increased adoption is likely to be driven by improvements in user interfaces and the development of seamless payment systems. Existing examples of crypto-friendly payment solutions demonstrate the potential for mainstream integration, but broader adoption still faces hurdles.

Possible Future Applications of Blockchain Technology in Finance and Other Industries

Blockchain technology offers transformative potential beyond cryptocurrency. Applications in supply chain management, voting systems, and secure data storage are already being explored. The ability to track assets and transactions transparently could lead to increased trust and efficiency in various sectors. For example, the potential for decentralized finance (DeFi) to revolutionize traditional financial services is significant.

Potential Future Innovations in Crypto Security and Risk Mitigation

Security remains a critical concern in the cryptocurrency space. Future innovations may involve advanced encryption methods, multi-factor authentication, and improved risk management strategies. The development of robust security protocols is vital for attracting and retaining institutional investors and fostering broader adoption. The rise of sophisticated cyberattacks and scams necessitates constant adaptation and vigilance in security measures.

Potential Impact of Artificial Intelligence on Crypto Markets

AI has the potential to significantly impact crypto markets by automating trading strategies, enhancing security measures, and improving market analysis. AI-powered algorithms could identify patterns and predict market movements, though the risks of algorithmic bias and market manipulation must be addressed. Current examples of AI use in finance, like algorithmic trading, demonstrate its potential in the crypto space.

Potential Emerging Cryptocurrencies or Tokens and Their Possible Impact on the Market

New cryptocurrencies and tokens emerge regularly, driven by innovative concepts and potential applications. The impact of these newcomers varies, from creating niche markets to challenging existing players. The successful launch of new tokens, like those in the DeFi space, can significantly reshape the market. For example, successful projects can draw significant capital and attention to a particular technology or use case.

Potential Scenarios for the Crypto Market in the Next 5 Years

| Scenario |

Trading Volume |

Market Capitalization |

Adoption |

Security |

Impact of AI |

| Optimistic |

High growth |

Significant increase |

Widespread |

Improved |

Transformative |

| Moderate |

Steady growth |

Modest increase |

Limited adoption |

Adequate |

Supportive |

| Pessimistic |

Declining |

Significant decline |

Limited |

Vulnerable |

Mixed |

The table above illustrates potential scenarios for the next 5 years. Each scenario depends on numerous factors, including regulatory developments, technological advancements, and market sentiment.

Illustrative Examples of Future Predictions

Predicting the future of the crypto market is inherently challenging, as it’s a dynamic and often unpredictable landscape. Past predictions, both accurate and inaccurate, offer valuable insights into the factors that shape the crypto market’s trajectory. Understanding these examples can help investors and analysts navigate the complexities of the market and potentially identify patterns that could influence future trends.

Past Predictions and Their Outcomes

Examining historical predictions provides a framework for evaluating the reliability of future projections. Some predictions have materialized, while others have fallen short. The accuracy of predictions hinges on the accuracy of the underlying assumptions and the ability to anticipate market reactions to unforeseen events.

- Early Bitcoin predictions often highlighted its potential as a decentralized currency, a revolutionary idea that resonated with many. However, the early predictions also underestimated the regulatory hurdles and the volatile nature of the market.

- Many predictions regarding the adoption of cryptocurrencies by mainstream businesses and financial institutions have proven to be complex and lengthy, often taking longer than anticipated. The adoption pace depends on regulatory clarity, technological advancements, and public perception.

- The prediction of specific cryptocurrencies reaching a certain price point frequently fails to consider the inherent risks associated with investments in highly volatile markets. The market is influenced by various factors, including news cycles, investor sentiment, and technological advancements.

Successful and Unsuccessful Crypto Projects

The crypto market is filled with both successes and failures, each offering valuable lessons. The factors contributing to the success or failure of a project often include technical innovation, community support, marketing strategies, and regulatory compliance.

- Examples of successful projects include Bitcoin, Ethereum, and Solana, which have demonstrated significant adoption and market capitalization growth. These projects have generally maintained a strong developer community and have successfully addressed core challenges.

- Conversely, many projects have failed to gain traction or have experienced sharp price drops. These failures can be attributed to factors like poor development, lack of utility, or insufficient community support. The impact of these failures is often felt across the entire market.

- Analyzing the history of successful and unsuccessful projects provides insights into critical factors for future development.

History of Notable Cryptocurrencies and Their Impact

Understanding the history of notable cryptocurrencies is crucial for comprehending the evolution of the market. Each cryptocurrency has a unique story, influencing the overall market in various ways.

- Bitcoin, the pioneering cryptocurrency, established the foundational principles of decentralized digital currency and laid the groundwork for the entire ecosystem.

- Ethereum’s introduction of smart contracts revolutionized the industry, fostering the development of decentralized applications (dApps) and establishing a platform for numerous other projects.

- The emergence of newer cryptocurrencies, often aiming to improve upon existing platforms or address specific needs, has had varying impacts on the overall market.

Impact of Notable Events on the Crypto Market

Significant events, both within and outside the crypto space, can profoundly impact market trends. Events such as regulatory changes, technological breakthroughs, and global economic fluctuations can have dramatic consequences.

- Major regulatory announcements, such as those regarding cryptocurrency regulation in various countries, can cause substantial price fluctuations and affect investor sentiment.

- Significant security breaches or hacks can severely damage the credibility and stability of a cryptocurrency project or platform, impacting user confidence.

- Market-wide events, like significant shifts in investor sentiment or macroeconomic trends, can affect the overall crypto market.

Significance of Crypto-Related News and Events

Staying informed about crypto-related news and events is crucial for navigating the market effectively. News and events can trigger immediate and significant reactions.

- News regarding regulatory developments or technological breakthroughs can trigger significant price movements, potentially creating profitable or risky opportunities.

- Important announcements by major cryptocurrency companies or projects can impact the overall market sentiment and influence investor decisions.

- Understanding the significance of different news events is crucial for effectively assessing market conditions.

Successful and Failed Crypto Investment Strategies

Various investment strategies have been employed in the crypto market, with varying degrees of success.

- Strategies based on technical analysis, fundamental analysis, or market sentiment often prove effective, but they also have limitations and can be risky.

- Investing in projects with strong fundamentals, promising use cases, and supportive communities is often a key to success.

- Successful crypto investment strategies are tailored to individual risk tolerance and investment goals.

Summary Table of Past Predictions and Outcomes

| Prediction |

Outcome |

Reasoning |

| Bitcoin will reach $100,000 by [Date] |

Partially True |

While the price reached high values, it did not fully meet the prediction. |

| [Specific altcoin] will disrupt the DeFi market |

Failed |

The project lacked the necessary features and community support. |

| Increased regulation will stifle the market |

Partially True |

Regulation has impacted certain areas, but the market has also adapted. |

Conclusion

In conclusion, the crypto market’s future is complex and dynamic, presenting both exciting opportunities and significant challenges. Understanding the interplay of economic, technological, and regulatory forces is crucial for navigating this evolving landscape. The analysis presented here provides a comprehensive overview of potential trends, risks, and opportunities, offering valuable insights for investors and stakeholders.

FAQ Overview

What are the biggest risks associated with cryptocurrency investment?

Volatility, security breaches, regulatory uncertainty, and market manipulation are significant risks in the crypto space. Understanding these risks is crucial for informed investment decisions.

How will institutional investment impact the crypto market?

Increased institutional investment can lead to greater market stability, liquidity, and adoption. However, it could also potentially exacerbate price volatility if large investors exit en masse.

What role does social media play in shaping crypto adoption?

Social media significantly influences public perception and adoption rates. Positive narratives and endorsements can boost interest, while negative sentiment can lead to market corrections.

What are some potential emerging cryptocurrencies or tokens?

Identifying emerging cryptocurrencies is challenging and speculative. The Artikel suggests exploring projects with innovative use cases, strong development teams, and growing community support.